The Challenge

In 2019, the National Board of Revenue of Bangladesh put out a general order whereby any business entity with sales turnover exceeding a stated amount, is mandatorily required to use Board-approved VAT software. Cloud-based deployment was permissible, but an on-prem database server was binding.

iVAT is an off-the-shelf, Board-approved VAT management software of brac IT. Designed for enterprises of all sizes in manufacturing, trading, and service industries, it’s trusted by over 30 multidimensional businesses. Our client selected it from over 40 ready-made market options after scrutinizing its security features, suitability with their IT environment, and cost-effectiveness. Thanks to a host of security controls like MFA, SQL injection, JwT, session forgery, and compliance with central bank security guidelines, iVAT is outfitted with multiple layers of data protection measures.

Unlike a custom build that could’ve dragged on for months and burned through budgets, iVAT delivered a capable turnkey fix. It slashed compliance headaches, streamlined VAT submissions with ease and accuracy, and turned a regulatory burden into a hassle-free affair for our client.

- Implementation & Quick Wins

iVAT was deployed on Microsoft Azure while adding an on-prem database to meet legal demands for Xiaomi. The rollout went live in days through straightforward configurations aligned with the Board’s strict guidelines. Staff training followed with hands-on sessions for smooth onboarding.

Besides platform independence and flexible deployment capabilities, iVAT offers quick and easy data entry features. The Xiaomi team could do direct input, import spreadsheets, or integrate with other platforms via API, offering flexibility for their workflows. Furthermore, profiles of products, suppliers, distributors, and other value-chain stakeholders can be created on iVAT. Once created, this data could be quickly accessed, taking out manual data entry efforts for a new transaction.

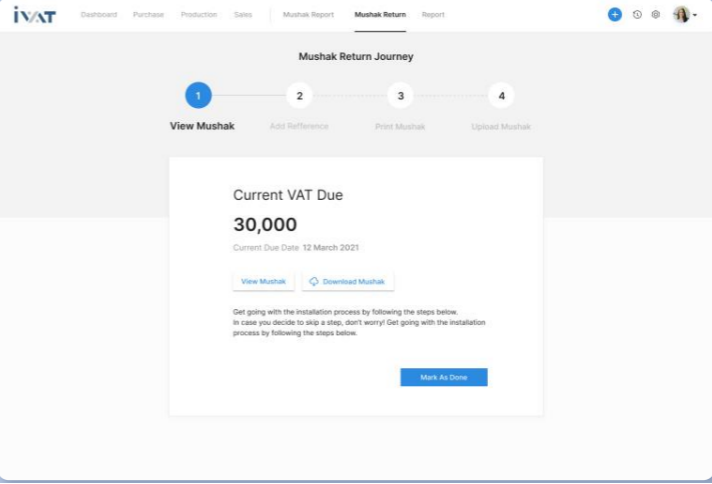

iVAT streamlined the entire VAT return process for Xiaomi. From importing spreadsheet data to entry on VAT submission forms, validating those entries in real-time, and exporting Board-compliant files with a few clicks, iVAT automated a time-consuming and error-prone process.

The Extent of iVAT’s Capabilities:

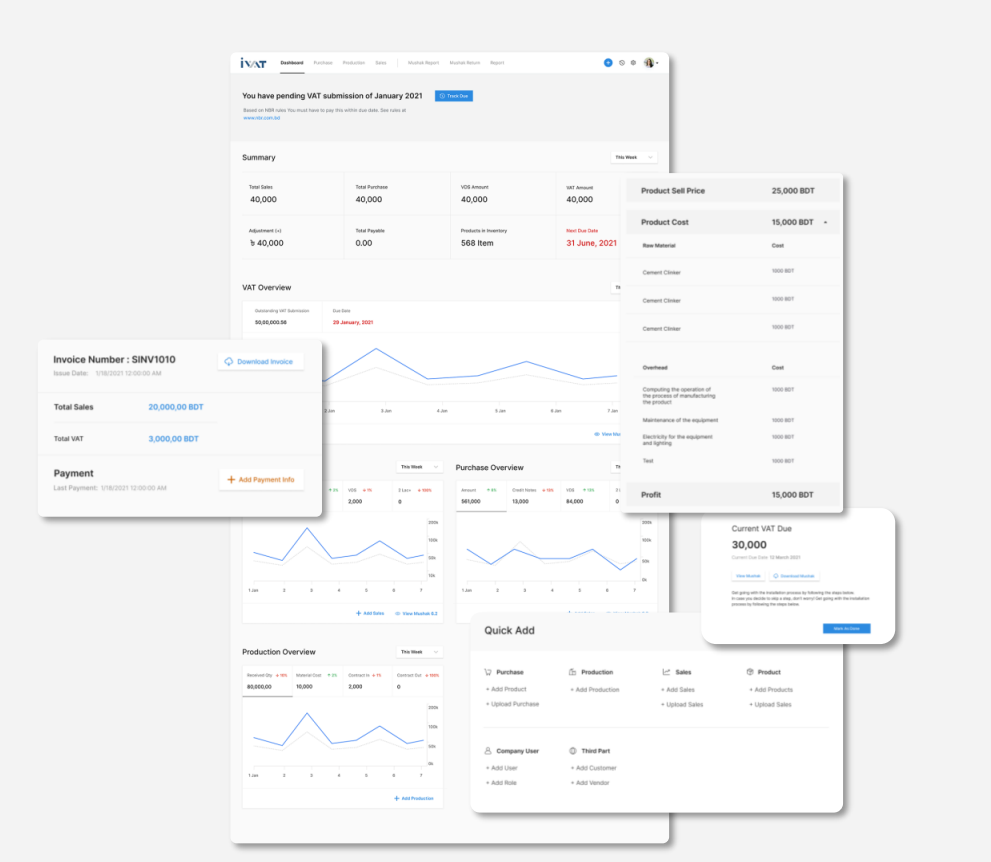

iVAT’s a Swiss Army knife packaged as a VAT management software. It doubles as a database, letting users create and save profiles for products, suppliers, customers, and partners, as well as store trade license, tax certificates, and BINs. It tracks stock of goods sold and updates inventory information with every dispatch cycle. Users can automate the input-output co-efficient declarations, detailing raw material costs and overheads per unit as required by law.

Detailed MIS reports can be configured to dive into purchase, sales, VAT, and more in granular detail. Dynamic dashboards help pull it all together, freeing companies like Xiaomi from the effort required to assimilate the insights from multiple sources. iVAT can also log transaction types, payment methods, invoice numbers, transaction IDs, serving as a source of truth for audits and accounts management.

iVAT’s win at Xiaomi charts a clear path for others. As an off-the-shelf solution which serves over 30 unique businesses, its rapid deployment and adaptability suit any manufacturing, trading, or service-oriented businesses grappling with at compliance. The rapid go-to-live timeline and time-to-value are draws for businesses prospecting a fast and dependable solution.

Whether handling sensitive partner data or scaling with sales, iVAT’s quick and easy data entry, deployment flexibility, and vast suit of capabilities proves its versatility. This success suggests peers in Bangladesh’s competitive market can lean on brac IT’s expertise to conquer regulations, cut costs, drive efficiency, and thrive in business.

About The Author

Jonathan Das

Communication Manager

Jonathan Das is a Communication Manager specializing in solutions storytelling and product marketing. He’s previously worked in brand and social media management, fund-raising, and audio-visual production roles with consumer brands, global non-profits, and startups. Jon holds a BA degree in communications from University of Liberal Arts Bangladesh. He enjoys making music, going on long walks, and reading about culture and technology.