The Challenge

During FY 2021, our client disbursed a total of over 15 million loans, of which over 20% defaulted. This regular occurrence necessitates about $120 million in provisions annually. The financial strain potentially compromises their ability to serve an additional 250,000 clients.

The challenge was on two fronts –

a) Traditional assessment methods lacked predictive accuracy, making it difficult to proactively identify high-risk borrowers.

b) True KYC verification wasn’t feasible due to lack of integration with any national identity database, essentially leaving client’s processes vulnerable to identity frauds.

The situation called for a solution to predict high-risk loans and minimize financial losses while ensuring efficient loan disbursement and fraud prevention.

The Solution

We developed a deep-learning system powered by statistical analysis to predict loan defaults within the first 4 months of disbursement. The algorithm was trained on over 20 million data entries – essentially 10 years of loan data – under supervised learning conditions. It analyzes 30 factors and variables as varied as financials, product type, borrower behavior, loan utilization specifics, geography, that can influence loan performance.

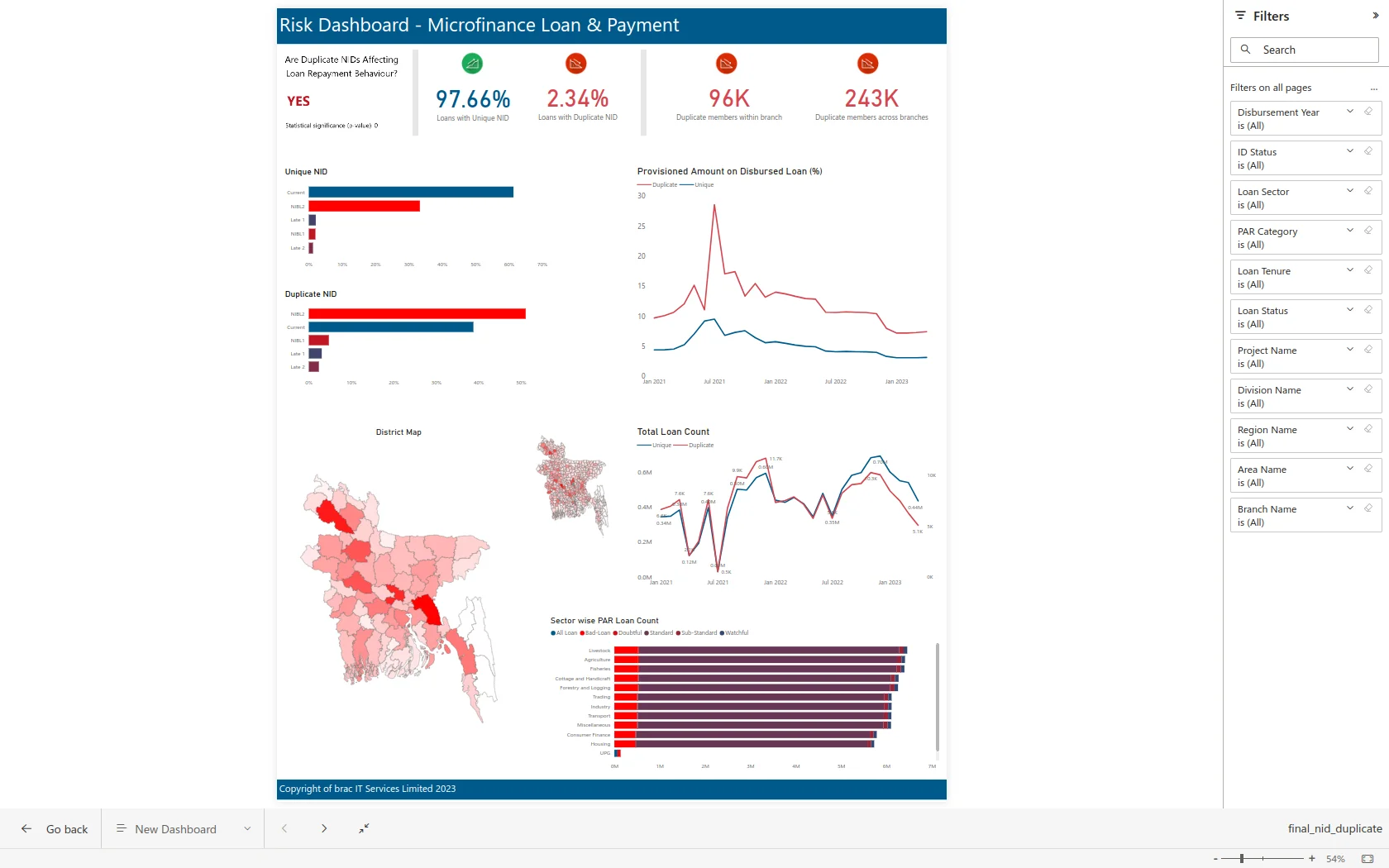

The integration of our client’s ERP with a state-owned citizen database was a complex and long path. As a simpler and cost-effective method, we designed and tested a data solution to detect duplicate national IDs and their associated loan statuses.

- Proof of Things to Come

Like most ML initiatives, iteration is key. Initially the ratio of training to test data was comparatively higher, which produced bias in its predictions along with false positives. Our data engineers kept experimenting with the variables, training data ratio, and human supervision to finetune the model. For a POC, the model could predict within the first 4 months if a borrower was to default or not, with an accuracy of 81%. The model can dive deep into factors behind loan performance such as client age, profession, gender, geography, loan size, loan utilization areas – unearthing behavioral tendencies previously inaccessible to our client.

The system in combination with human analysts, preexisting rule-based system, and further statistical techniques could act as a veritable solution for the client’s pain points.

As for fraud detection, the POC enhanced data security by removing over 320,000 duplicate data entries and integrating loan statuses with national IDs. The system has been equipped to automatically flag duplicate ID entries bearing unique loan statuses, escalating it to human analysts for further inspection.

Potential Impact & Future Implications

Upon deployment, the solution is expected to help limit our client’s risk surface area by providing early warnings for potential loan defaults, enabling better financial risk management. Secondly, the data can be harnessed to formulate lending strategies based on model insights.

The POC was developed throughout 2024 and awaits piloting in 2025. It was envisioned as part of a larger platform called Microfinance Analytics. Fragmented data, manual reporting, and no centralized analytics make it difficult to track loan performance, savings behavior, and branch performance. This leads to delays in decision-making, inefficient risk management, and difficulty identifying high-risk loans and fraud. With an operation spanning across 3,800+ branches, thousands of employees, and over 11 million clients, pain points can get thorny at this scale.

The Microfinance Analytics platform, a real-time data analytics system will be deployed to enhance day-to-day operations, predict risk with high accuracy, and propel our client’s financial inclusion goals even further. Our prediction and fraud detection tools will be key components for bringing an effort of this magnitude into the AI age.

About The Author

Jonathan Das

Communication Manager

Jonathan Das is a Communication Manager specializing in solutions storytelling and product marketing. He’s previously worked in brand and social media management, fund-raising, and audio-visual production roles with consumer brands, global non-profits, and startups. Jon holds a BA degree in communications from University of Liberal Arts Bangladesh. He enjoys making music, going on long walks, and reading about culture and technology.