The Challenge

The client sought to extend its services to underserved populations beyond the physical reach of its branches. The challenge was to find a way to scale access to financial services through community-based channels. To achieve this, they piloted a commission-based model, incentivizing mobile money agents to refer leads from local communities.

However, the manual process involved considerable paperwork and inefficiencies:

• Field operatives verified the leads submitted on forms by agents

• Area Managers reviewed these forms to assess loan eligibility

• The entire process depended on the physical reach of BRAC’s 3,700+ branches, limiting its potential scalability

The method was slow, costly, and reliant on extensive physical presence, which hindered the speed and reach of the program.

The Solution: Ekota (a Bengali word for unity)

A tailor-made mobile application called Ekota was designed to digitize the lead generation and approval processes with scalability. Ekota eliminated the paperwork, enhanced operational efficiency, and expanded the referral network, enabling our client to offer financial services to large swaths of the underserved population. The business analysis and development took seven months before going into pilot in December of 2023.

- Pilot

The MVP was piloted from December of 2023 to April of 2024 in two regions of Bangladesh with selected partners. The initial months were challenging, with low commission payouts. However, as the system scaled, the number of successful transactions grew, eventually reaching over thousands of daily commissions. During this period, some key adjustments were made such as –

• Server provisioning and codebase optimization to handle higher volumes

• User training and system refinement to improve partner engagement

- National Launch & Impact

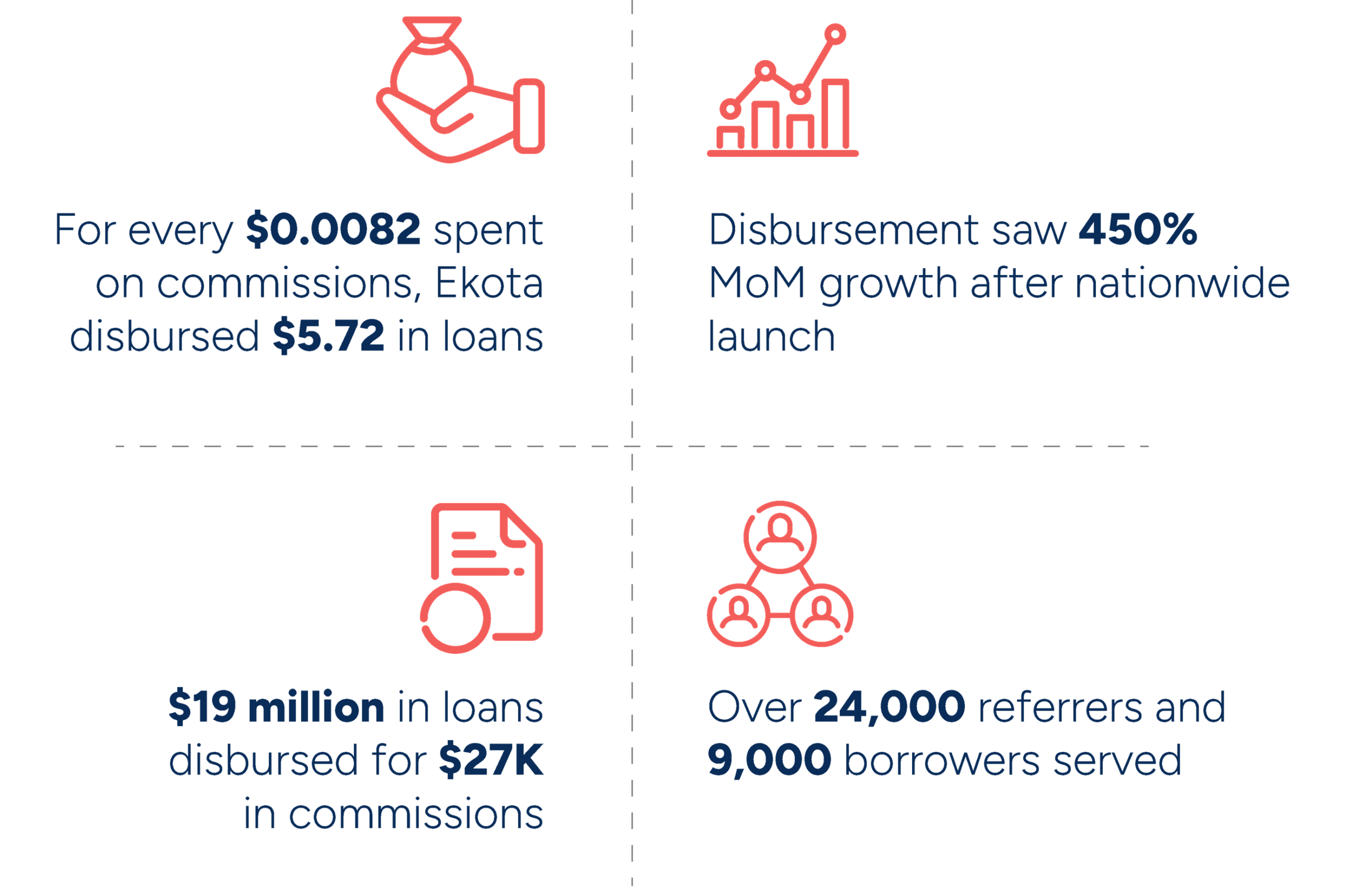

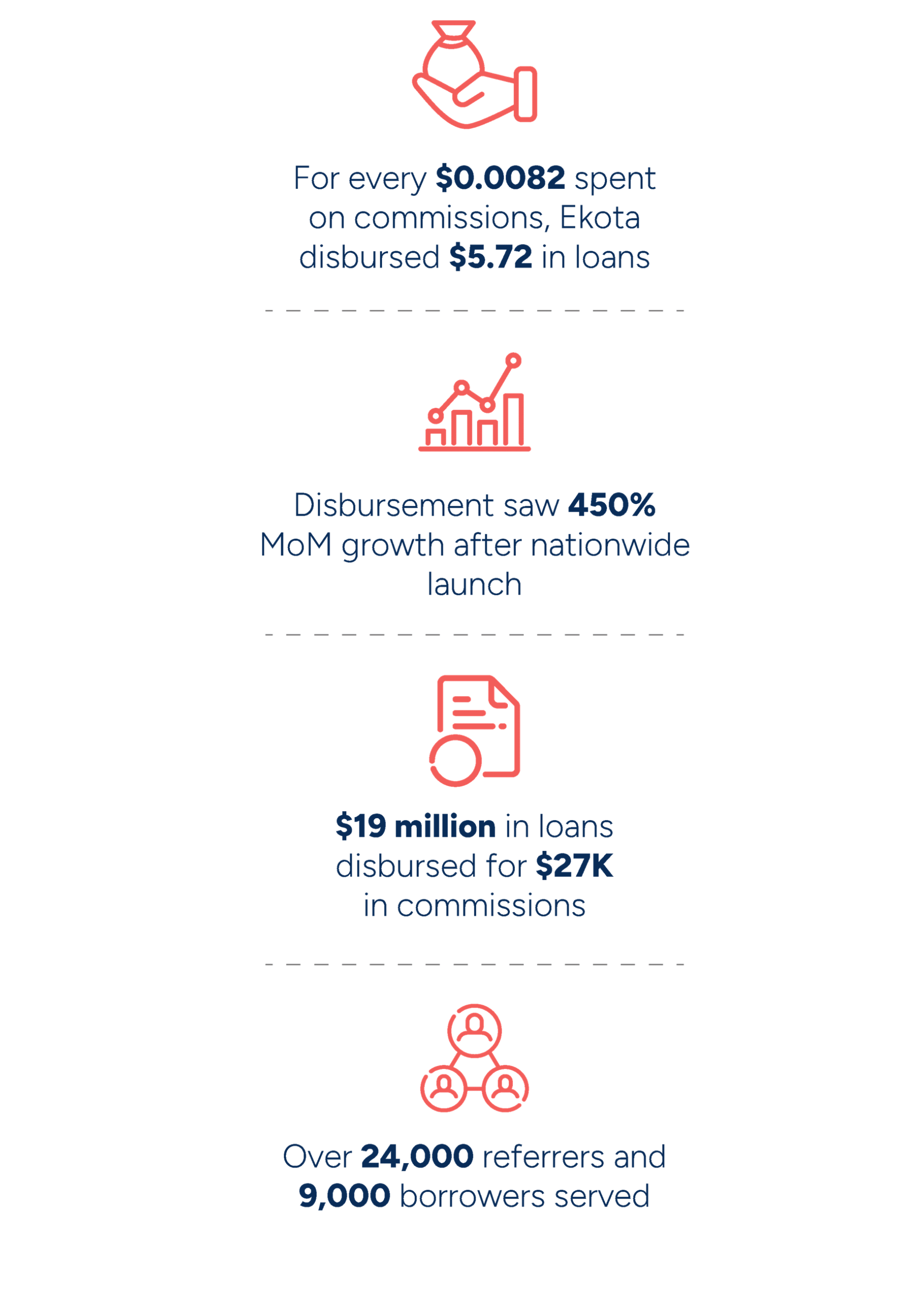

Ekota was launched across Bangladesh in April 2024 through its network of existing microfinance clients, mobile money agents, and community leaders. The nationwide expansion enabled thousands of new referrals and firmly established Ekota as a driver of BRAC’s financial inclusion strategy. As of January 2025, Ekota has shown significant impact, both in terms of financial metrics and community outreach.

To put this in perspective, Ekota’s cost-efficiency in driving loan disbursements far outpaces conventional digital outreach. For example, LinkedIn Ads typically generate a $2.30 return for every $1 spent. Ekota delivered more than double that impact with a community-led model.

National Launch & Impact

Ekota was launched across Bangladesh in April 2024 through its network of existing microfinance clients, mobile money agents, and community leaders. The nationwide expansion enabled thousands of new referrals and firmly established Ekota as a driver of BRAC’s financial inclusion strategy. As of January 2025, Ekota has shown significant impact, both in terms of financial metrics and community outreach.

To put this in perspective, Ekota’s cost-efficiency in driving loan disbursements far outpaces conventional digital outreach. For example, LinkedIn Ads typically generate a $2.30 return for every $1 spent. Ekota delivered more than double that impact with a community-led model.

Looking Ahead

Plans are underway to integrate Ekota with BRAC Microfinance’s fintech platforms for lead conversion and commission payout management, enhancing ecosystem efficiency. The product’s evolution will further include improved AI-driven fraud prevention measures, ensuring greater transparency in commission tracking and disbursement.

Ekota’s journey from pilot to nationwide rollout illustrates the demonstrable impact of digital solutions on large-scale financial inclusion efforts. By streamlining the lead generation and loan approval process, Ekota has expanded BRAC Microfinance’s reach far beyond its physical network, helping thousands of underserved individuals access crucial financial services.

About The Author

Jonathan Das

Communication Manager

Jonathan Das is a Communication Manager specializing in solutions storytelling and product marketing. He’s previously worked in brand and social media management, fund-raising, and audio-visual production roles with consumer brands, global non-profits, and startups. Jon holds a BA degree in communications from University of Liberal Arts Bangladesh. He enjoys making music, going on long walks, and reading about culture and technology.